Income inequality is a systemic risk to investors. Left unchecked over the last 40 years, income inequality has intensified in scope and scale worldwide. Today, the richest 1% have more than twice as much wealth as nearly 90% of people in the world combined.

Income inequality is a systemic risk to investors. Left unchecked over the last 40 years, income inequality has intensified in scope and scale worldwide. Today, the richest 1% have more than twice as much wealth as nearly 90% of people in the world combined.

This dramatic level of inequality affects all investments across all asset classes. Without action, we risk the further destabilization of our economy and our society. While governments can and should play a fundamental role in addressing income inequality, investors maintain a unique ability to leverage their capital and influence as an integral part of the response.

To support investors in confronting and managing the systemic risk of income inequality, TIIP released a new report, Systemic Stewardship: Investing to Address Income Inequality. This report builds on a previous income inequality toolkit, and examines and re-defines the notion of stewardship to include the consideration of social and environmental systems alongside financial returns.

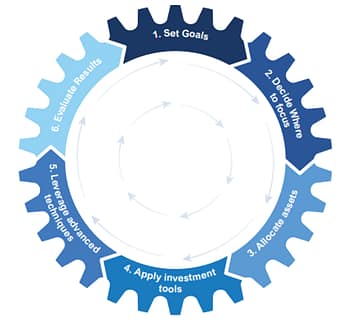

The report, which was made possible by the support of The Generation Foundation, offers a six-step process for investors to tackle systemic issues, such as income inequality:

- First, investors must set a system-level goal that affects their investments across all asset classes.

- Next, investors must decide where to focus and commit to addressing a certain systemic issue, like income inequality.

- After deciding where to focus, investors must allocate their assets accordingly.

- Then, investors can extend conventional investment tools to exercise system-level influence.

- Investors can further leverage advanced techniques designed specifically to manage systemic risks and rewards.

- Finally, investors should evaluate their results towards their stated goals.

Fundamentally, this guide shows how investors can protect and enhance the long-term value of their assets while acting as stewards of underlying social and environmental systems. It applies the principles and approaches outlined in the book 21st Century Investing: Redirecting Financial Strategies to Drive Systems Change.

Fundamentally, this guide shows how investors can protect and enhance the long-term value of their assets while acting as stewards of underlying social and environmental systems. It applies the principles and approaches outlined in the book 21st Century Investing: Redirecting Financial Strategies to Drive Systems Change.

While Systemic Stewardship focuses on the issue of income inequality, the stewardship process laid out provides investors with the necessary tools to confront other system-level challenges facing the world today, such as public health crises and climate change. This new stewardship process, alongside TIIP’s Build the Market Initiative, provide investors with needed implementation guidance for taking system-level investing from theory to practice.

Download the full report here.[/vc_column_text][/vc_column][/vc_row]